Market Review - Aug/Sept 2021

Rent prices stumble into negative territory

Rent prices stumble into negative territory

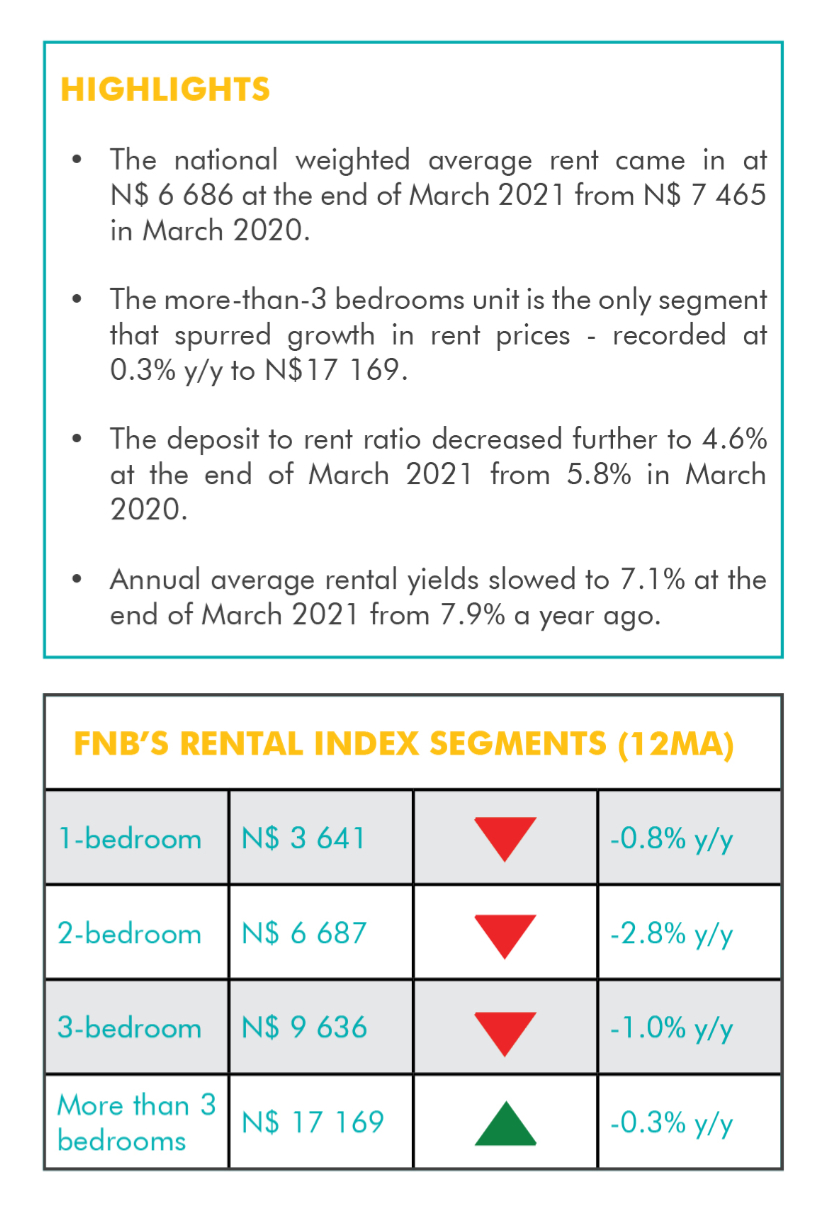

The FNB Residential Rental Index posted an annual contraction of 3.1% at the end of March 2021, from 0.0% a year earlier. This brings the national weighted average rent to N$ 6 686 from N$ 7 465 recorded in March 2020. The 1-bedroom, 2-bedroom and 3-bedroom segments saw annual rental contractions of 0.8%, 2.8% and 1.0%, reaching N$ 3 641, N$ 6 687 and N$ 9 636, respectively. The only segment that showed annual growth in rent prices is the more-than-3-bedrooms unit which registered growth of 0.3% to N$ 17 169. These patterns highlight the widespread affordability issues amongst tenants and increased demand for multi-family renting units to support affordability in these economically challenging times.

Indeed, the incoming economic data for the first quarter of 2021 mirrors the deteriorating state of the rental market, with GDP growth recorded at -6.5% from -2.5% in the corresponding quarter of 2020. Suffice to say, a derailed economic recovery, which appears to have been prolonged by the third wave of COVID-19, and low vaccination rate is poised to keep the rental market in a “coma” on the back of muted demand. This would have far-reaching implications for the stability of the financial sector, with potential unfavourable consequences such as depressed property sales. While we do not believe we have effectively reached that state yet, some signs are emerging. For instance, the real estate and professional activities are amongst the five sectors that carried through the economy in the first quarter of 2021, realizing growth of 4.6% y/y.

This is further supported by a considerable growth in home sales seen over the reviewed period. Looking at the regions, Walvis Bay continued to top the list in terms of annual rental contractions with -44.4%, followed by Oshakati (-33.9%), Swakopmund (-28.4%), Ondangwa (-20.7%), Okahandja (-14.4%), Gobabis (-14.2%) and Windhoek (-3.5%). Conversely, rent in Tsumeb, Rundu and Ongwediva grew by 35.8%, 31.0% and 20.2% y/y, respectively. These robust growth figures point to a high vacancy rate in the middle market segment across these jurisdictions as affordability issues linger.

Deposit to rent ratio

Overall deposits charged by landlords contracted by 23.0% y/y at the end of March 2021 compared to a contraction of 32.1% y/y recorded during the same period of 2020. The relatively mild contraction in rental deposit on the year-on-year basis highlights the low base effect from the first quarter of 2020 when the economy went into the first phase of COVID-19 lockdown. Overall, a significant reduction in deposit payable of 60% is notable within the more-than-3-bedrooms segment compared to a reduction of 30% realized a year earlier. This state of affairs is reflected in a continued deceleration of the deposit-to-rent ratio, reaching 4.6% at the end of March 2021 from 5.8% in March 2020. Looking ahead, competition for high quality tenants is a theme that we believe will continue to shape the outlook of the rental property market for as long as the economy remains in a recessionary state.

Rental yields

The yields on residential investment property have declined considerably as rental growth fails to keep up with rising housing prices, especially in the medium to low housing market. At the end of March 2021, the return on an investment property was measured at 7.1%, reflecting a 0.8 percentage point decline from the preceding period. Although we still view the current rental yields as indicative of a stable residential property market, the attractiveness of the residential property as an asset class would continue to depend on how soon the economy would return to its sustainable growth path.

Conclusion

The rental market is an increasingly important pillar for the Namibia property market. However, given the ailing economy and sluggish demand, rent prices are likely to remain muted for the long haul. Meanwhile, the emergence of the multi-family and vacation rental markets appears to have gained prominence particularly in the coastal and central towns.

Frans Uusiku

Marketing Research Manager

For more information, please call: 061 – 299 2222 or visit www.fnbnambia.com.na

To make sure we reach targeted readers audience, selective distribution is done throughout the month on a weekly basis. This ensures the availability of the magazine in strategic locations for readers to pick up for free and read.