Market Review - Oct/Nov 2020

Second quarter house prices favour buyers

Second quarter house prices favour buyers

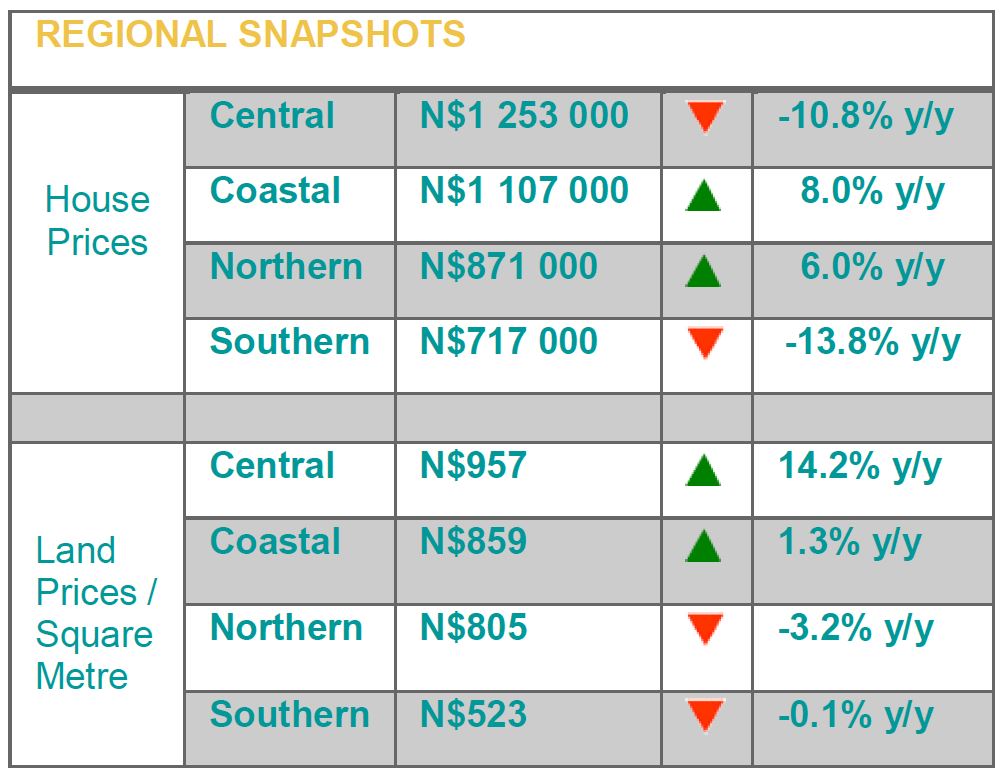

The FNB House Price Index posted a contraction of 2.7% y/y at the end of June 2020, compared to contractions of 5.6% and 3.7% y/y recorded at the end of March 2020 and June 2019 respectively. This brings the national weighted average house price to N$1 044 956 as at June 2020. House price gains were notable in the Coastal and Northern regions, registering growth of 8.0% and 6.0% y/y respectively. Meanwhile, double digit contractions in house prices of 10.8% and 13.8% y/y were recorded in the central and southern regions due to affordability issues. As a result, the elevated demand for land in the central region led to a 12-month average price growth of 14.2% per square metre at the end of June 2020, compared to a contraction of 13.0% y/y recorded over the same period of 2019. This can be ascribed to high bid prices offered for the purchase of land mainly by private developers.

Frans Uusiku, Market Research Manager at FNB, noted that although market sentiments may appear to point to further declines in house prices due to expected distressed sales, it seems that the downward trend has reached its bottom. He mentioned two reasons: Firstly, house prices have only registered an annual compounded growth of 6% since 2009, which is lower than the 9% growth observed in mortgages over the same period. Secondly, there has been a 91% positive correlation between house prices and mortgages since 2009. This could imply that house price appreciation realised since the 2008 global financial crisis was associated with a corresponding growth in mortgages. “Therefore, from a seller’s perspective, trading activity below the prevailing average price levels may prove difficult due to high levels of indebtedness.” Referring to the Regional Snapshot table printed alongside, Uusiku added that, on a 12-month moving average, a house in Windhoek is now priced at N$1 188 000, having contracted by 2.8% q/q and grown by 8.4% y/y.

“Conversely, Okahandja and Gobabis recorded annual contractions in house prices of 3.7% and 11.5% y/y, settling at N$764 000 and N$670 000 respectively by the end of June 2020.” Meanwhile, volumes traded in the central region at -4.9% y/y as at June 2020 from 34.5% y/y registered over the corresponding period of 2019. The medium housing segment recorded a volume index growth of 14.2% y/y compared to a growth of 7.5% y/y recorded in June 2019. Houses in the higher-end market segment (large to luxury) sold below valuation due to affordability issues. The market for the smaller housing segment saw a continued contraction in the volume index of 8.0% y/y as at June 2020 compared to average annual growth of 40% y/y seen in the last two years. The revival of the small housing market in this region would largely be dependent on the extent of land delivery and construction of new residential developments. In the coastal region, Uusiku added, Walvis Bay and Henties Bay have consistently sustained price growth. In effect, house prices in Walvis Bay and Henties grew by 6.5% and 6.0% y/y to N$742 000 and N$776 000 as at June 2020, respectively. “On the flipside, selling a house in Swakopmund has proven difficult in recent times due to economic hardship. This is particularly true for the mining and construction sectors which have traditionally been the key engine of the housing market in this region. Consequently, about 90% of houses sold over the last 12 months have been concentrated in the small housing segment – resulting in house price contraction of 10.4% y/y to N$720 000 as at June 2020.”

“The improvement in trading activity in the North was more evident in Katima Mulilo, Rundu, Ondangwa and Oshikuku which spurred growth in house prices of 60.5%, 7.9%, 7.1% and 7.1% y/y respectively.” Uusiku pointed out that there is strong demand for housing in the northern region, with the volume index showing annual growth of 16.5% y/y by the end of June 2020. “This continues to be the only region that has recorded growth in respect of volumes traded since mid-2019, because of the inherent dominance of the small housing segment. The housing market recorded an annual growth in volumes traded of 26.2% y/y at the end of June 2020 compared to 18.7% y/y recorded over the same period in 2019. However, trading activity is quieter in the medium, large and luxury housing segments as evidenced by continued contractions in volumes traded of 22.1%, 9.7% and 50.0% y/y respectively. Of the southern region, Uusiku noted that the region represents a very small fraction of the housing market, accounting for only 2% of overall transactional volumes since July 2019. “Looking ahead, the property market in the southern region is poised for advancement considering the notable acceleration of land delivery and decentralization of training programmes by UNAM and NIMT in that region.”

Frans Uusiku

Marketing Research Manager

For more information, please call: 061 – 299 2222 or visit www.fnbnambia.com.na

To make sure we reach targeted readers audience, selective distribution is done throughout the month on a weekly basis. This ensures the availability of the magazine in strategic locations for readers to pick up for free and read.